SEPTEMBER 21, 2016

- Investors are not rational and have to deal with biases.

- Investing biases can cost us significant return over time.

- Disposition, Confirmation, and Anchoring are few other biases with adverse consequences.

- Biases can be managed to improve investment performance.

As part of our writings on Systematic Investing, we continue with a look at Investors Biases. Today’s article is a follow-up to the article Understanding Our Investing Biases – Part 1.

Investing biases can be detrimental to our portfolios. Investors appear to have a bias towards “activity” and feel they’re under-thinking and under-performing, if they’re not actively managing the position. No wonder that legendary investor Warren Buffett has noted that the hardest thing to do in investing is to sit on your hands and do nothing.

Success in investing doesn’t correlate to IQ. Once you’ve ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.

Warren Buffett

Disposition Bias. Ever experienced the tendency of selling stocks that have appreciated in value (Winners), while holding stocks for too long that have declined in value (Losers). The bias of selling Winners too early while holding Losers too long is referred to as Disposition Bias. It’s closely related to the Loss Aversion or Regret Aversion Bias that was discussed in Part 1. This bias affects institutions as well. Researcher Andrea Frazzini, found out that the bias ends up creating a post-even drift higher when the news is positive. The reason being that many investors exit around the same time on a rising stock, putting pressure on the stock and holding it back, thus leading to the stock not reflecting the positive news immediately. Consequently, the stock drifts higher with a high predictability. The reverse is true when there is a bad news event, and consequently the stock drifts lower over time.

Besides hurting the returns, this bias can also create sub-optimal tax implications. The old Wall Street adage of “cut your losses and let your profits run,” can assist investors in developing the discipline to manage this bias.

Confirmation Bias. Ever see yourself gravitating towards an opinion which is in sync with your belief. It could be as harmless as watching a news channel that is more aligned with our political opinion and thus confirms our viewpoint or as pernicious as seeking out groups and information that confirms our investing hypothesis rather than looking for alternative hypothesis or arguments that do not confirm our opinion. Ever been to a community stock board where an opinion is largely one-sided, and how everyone gangs up on a counter-opinion that may show up. This is the world of Confirmation Bias.

Investors believe they are objective in evaluating facts. But often times, once we arrive at a conclusion, we seek out evidence that confirms and validates our opinion and conclusion. The tendency to test and evaluate ideas in a one-sided way and ignoring alternatives, can have an adverse effect on our portfolio.

This is a difficult bias to overcome for it can exist without us being aware of it. One thing that can contribute to managing this bias for investors is to seek out multiple sources of information and make a deliberate effort to learn about counter-points.

Anchoring Bias. Ever encountered a situation where you see an item on sale but don't buy, and then on subsequent visits you are unable to purchase that item at the regular price for our reference is the initial sale price. Similarly, at times when that big television is marked down 50%, our tendency is to focus on the 50% off and not realize if the television is still of value to us even at the lower price. These are example of Anchoring, a tendency where a certain piece of information gets anchored in our cognitive process and affects subsequent decision-making.

A used car salesperson sets an initial price, which becomes the basis for the rest of the negotiations. As the salesperson discounts the price further, anything lower than that initial price begins to look more reasonable, even if the price is still much higher than what the car is really worth.

Investors who experienced the economic crisis of 2007-2008 with fierce stock market declines, developed a bias against stock investing which kept them on the sidelines even when the markets recovered and continued to move higher. The Anchoring Bias drifted them towards an underweight in equities, and held back the portfolio performance.

Anchoring is a subjective lens through which we make future judgments. It is hard to purchase a stock at $25, when you saw the stock price at $15 a month ago, and often times you will simply wait for a pull-back to purchase at a price closer to the Anchor price in your mind. In this situation, we have anchored our judgment to the first piece of information that became embedded in our mind.

Anchoring needs strong discipline to overcome, and requires a more open mind which evaluates a wider range of investment options.

Overcoming Biases

These are only few of the biases that we encounter. The best way to overcome biases and control our tendencies that harm investment performance is to pursue an investing system, adapting the system when necessary, and working hard to ensure not to deviate from the system. Being aware of the biases can help in monitoring and diminishing them.

Discipline remains the key to a long-term, successful investment strategy. Active Management continues to struggle to outperform the relevant benchmarks, like S&P 500 (SPY), Nasdaq (QQQ) and Russell 2000 (IWM), as we recently highlighted in a recent article titled Active Management Loses Ground. Over 80% to 90% of the money managers are unable to outperform benchmarks over a 5-year period. Human biases contribute towards holding back active management returns, when compared to passive and quantitative strategies. Model-driven systematic investing is one way to mitigate the behavioral biases that affect human decision-making in active management, and also keep trading costs lower.

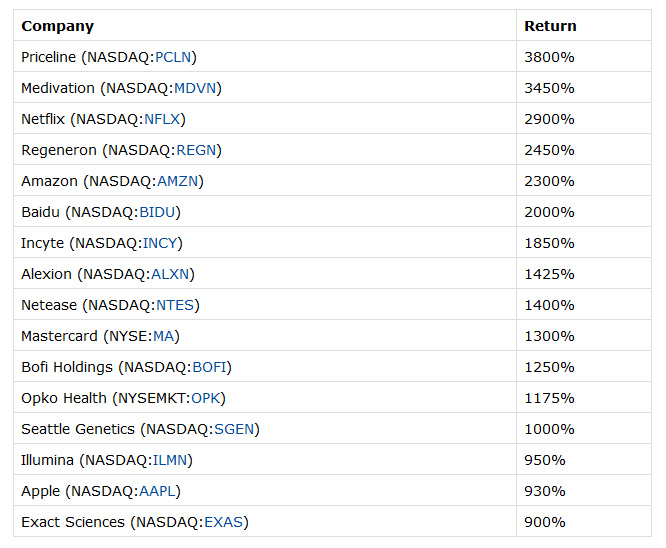

Further below is a list of a few of the larger cap top performers over last 10 years. Interestingly, Biotech is quite liberally represented. Perhaps some of us have been fortunate enough to hold these kind of names in our portfolios, and avoided the behavioral biases that may have kept us from them.

Good Luck Investing!

If you wish to add to this article or share your viewpoint, please leave a Comment for everyone's benefit. Thanks!

...The article was first published on Seeking Alpha

Click to enlarge table and images