Market Pulse

The stock market is into the final quarter in what most likely will turn out to be a strong ending to the year. It will be led by segments and sectors that have lagged the market rebound and are tied more closely to the state of the US economy. The technology sector remains the premier investing sector, and has led the Nasdaq (QQQ) and the S&P 5000 (SPY) higher. But this quarter will witness broader market participation that will finally have lagging indexes, like the New York Composite and small-cap Russell 2000 (IWM), approach or exceed the highs set earlier in February 2020.

Presidential Race and the Key Uncertainty Event

The Presidential race will continue to consume the month of October and the early days of November. While the time will be spent worrying and divining about the election outcome and the impact on the market, in our opinion, the market will head higher in the final months of the year whoever is elected President.

Presidential elections are seismic events, and every four years, the process leads to much uncertainty that seeps into every corner of the US economy and beyond. Once results are determined on election night, the political election risk extinguishes. The momentum from a favorable shift in risk-perception following the election is a giant wave of relief that lifts the stock market higher.

However, the biggest near-term risk comes from a contested election, particularly since the rhetoric around challenging the result and potential election fraud has intensified over the past few months. A contested election will drive the market to retreat sharply, even though it will be a short-lived pullback till a resolution occurs.

During October, a seasonally volatile but positive month, the theory of a contested election being a major influence on the stock market can be put to test. If true, then as the polling gap between the candidates remains steady or widens, it diminishes the risk of a contested election, and the stock market will respond positively or stay steady. If the polling gap begins to tighten, it commensurately raises the probability of a contested election, and the stock market will pull back.

In November, a contested election can lead to a 5-10% decline, if the precedent of a Bush-Gore contested election is to be observed. At its worst, the decline was 8% during that delay. But the Bush-Gore precedent is from almost a different era. With the present vitriol and the raking of fraudulent voting concerns, a contested election can descend into a prolonged and intractable situation. That can easily cause a steeper decline, beyond 10%, reflecting the potential for lasting economic damage and paralysis of the American policymaking institutions. However, any decline should prove to be short-lived, as an eventual resolution will propel the stock market higher.

Earnings and the Economy

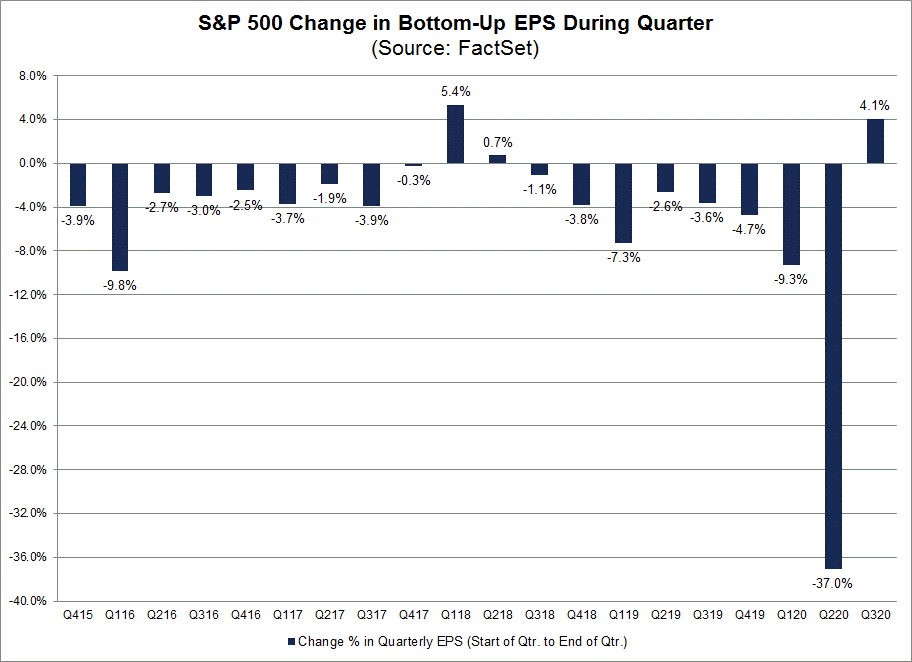

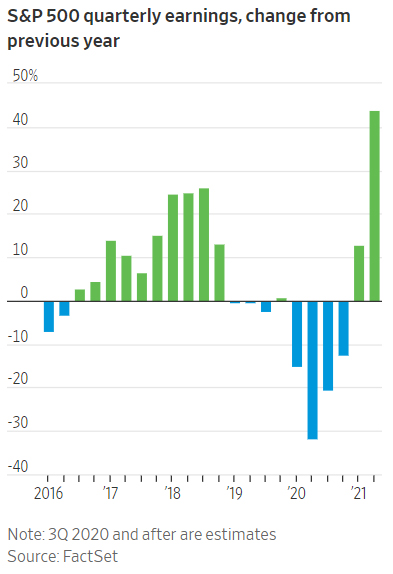

Whether the economic GDP expands at a slower pace or faces a temporary dip, earnings are on a growth trajectory and each quarter should improve on the prior quarter. Early stages of this trend are apparent in the S&P 500 earnings, where the quarterly estimate, computed as a comparison of estimates at the beginning of the quarter (June 30) and the end of the quarter (September 30), has risen for the first time since Q2 2018. In other words, analysts have been raising estimates for the quarter during the quarter itself, when typically they are trimmed down.

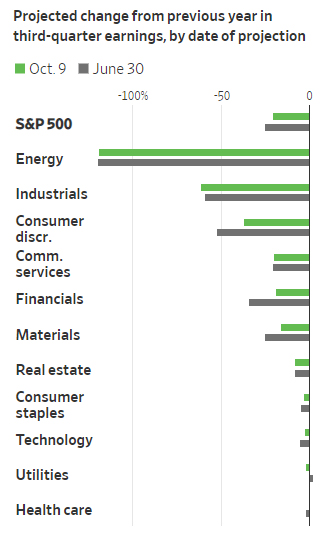

Earnings growth for the third quarter will still be negative in a year-over-year comparison for the index, but the size of the negative growth is shrinking as analysts are raising estimates for the quarter. And the improvement is across most industries, except for Energy and Industrials. The green bar in the chart below shows lower negative growth for the quarter, compared to the estimates at the beginning of Q3.

Is the Stock Market Unhinged from the GDP?

The economic rebound was sharper than most expected during the third quarter. But recent data is suggesting a moderating pace of growth, as evidenced by slower consumer spending, unemployment claims being persistently high, and surging layoff announcements. The pandemic impact continues to expand, but the stock market, particularly the Nasdaq, has performed well and recorded new highs.

How does it reconcile?

There is a transitory nature to the pandemic upheaval. The stock market is simply focused on the longer term, at the time beyond the pandemic when GDP will recover and achieve pre-pandemic levels. That may occur in the final quarter of 2021 or early 2022. With that framework, the stock market may not be overvalued. Management consulting firm McKinsey recently noted that even if it's assumed

that for the next two years, corporate profits will be 50 percent lower than they otherwise would have been and will then return to their precrisis levels and growth rates. If we discount the impact of lower short-term profits and cash flows, the present value of the stock market declines by less than 10 percent

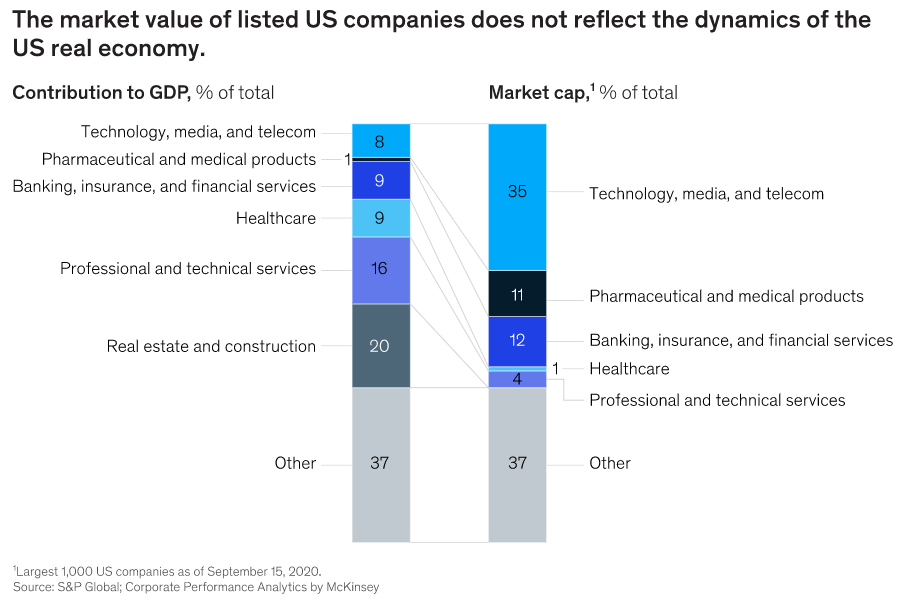

The stock market is not very representative of the GDP, and that's why it can be hard to understand the market's rise in the face of GDP turmoil. In fact, the stock market is quite heavily influenced by the Technology, Media, and Telecommunications (TMT) group, a fountainhead of earnings growth, that accounts for 8% of GDP but nearly 35% of stock market value.

Fiscal Stimulus

With earnings and economic growth beginning to turn favorable, and monetary policy firmly in favor of the stock market, another round of timely multi-trillion-dollar fiscal stimulus is going to only further drive consumer spending and boost economic growth on an economy that is already expanding, though losing some momentum. The doses of fiscal stimulus would continue to shorten the duration to achieve the pre-crisis-level GDP.

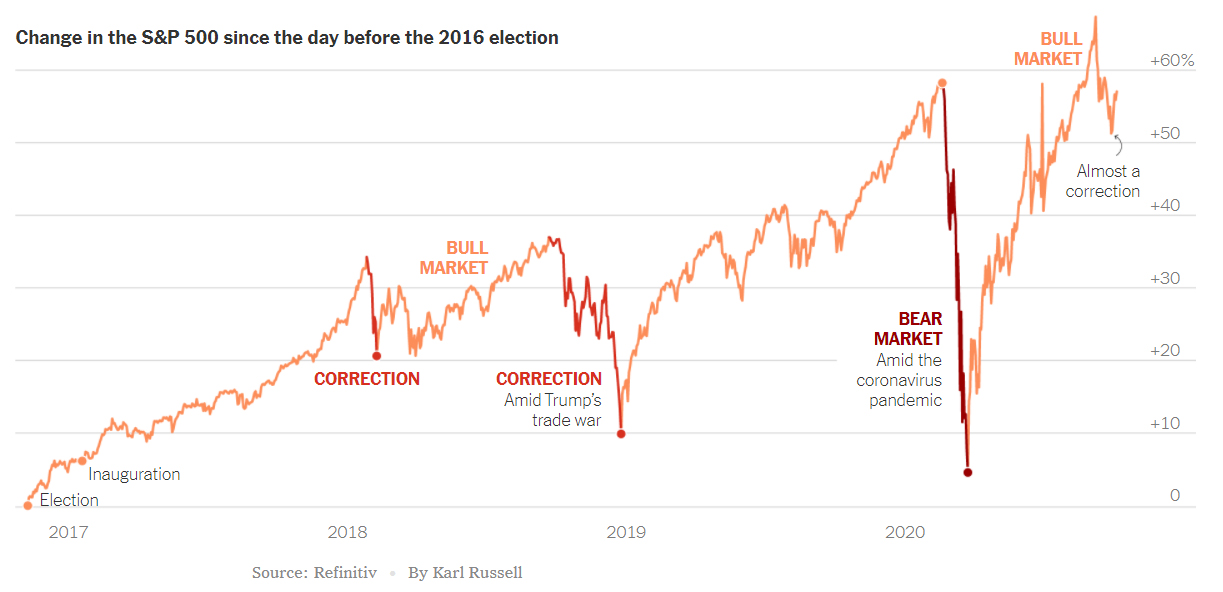

And the fiscal stimulus will come, whether Congress agrees in October or after the elections. And it won't end with the second Federal stimulus if the Presidency changes hands. Below is a stock market chart since the last election.

Conclusion

We noted in the opening paragraph that it is encouraging to see small caps and the New York Composite beginning to perform better, for it represents a broadening out of the recovery. The Dow Jones Transportation Index (IYT), highly cyclical, has continued to make new highs since last month, indicating economic momentum.

When an economy emerges from a recession, it is best to have at least a 1-2 year horizon and stay invested in stocks. Sizeable and relatively consistent gains are achieved in the earlier stages as the recovery eventually picks up momentum. The long-in-the-tooth old bull market risk is over and a new one has begun.

Small caps are beginning to find greater traction and have been steadily climbing higher this month. We believe biotechs are very well-positioned after a nearly 5-month sideways consolidation to strongly participate in a late-quarter rally. Both biotechs and small caps in general are more speculative than the broader market and are more adversely affected during volatile market conditions. So, a longer-term perspective is needed. At the beginning of October, the Russell 2000 index was still down -8% for the year. The Prudent Smallcap Portfolio was up +28% for the year. Some of the promising small cap companies, which may be part of our model portfolios now or in the past, include Seres Therapeutics (MCRB), Bloom Energy (BE), Trillium Therapeutics (TRIL), Celldex Therapeutics (CLDX), Camping World (CWH), Celsius Holdings (CELH), Cassava Sciences (SAVA), Digital Turbine (APPS), eXp World Holdings (OTC:EXPI), Kura Oncology (KURA), Revolution Medicines (RVMD), and Workhorse Group (WKHS). Small cap exposure can also be acquired through ETFs like the one tracking the Russell 2000 Index, IWM, and another tracking the S&P Smallcap 600 Index, IJR.