Fed Watch

The last meeting of the year for the Federal Reserve's Open Market Committee will determine if the broad rally for stocks and bonds will be sustained and make it to January or be reined in and pulled back.

While the Fed has indicated it does not need to raise rates at this point, it is the timing of future rate cuts that the market is more interested in. Expectations for a rate cut have risen to ~42% in March as per the CME's FedWatch tool. For May, the expectations have soared to 50% for a 25 basis points rate cut, while another 25% expecting a rate cut of 50 basis points. That's a marked shift with such optimism for a rate cut feeding the rally.

The Fed's Summary of Economic Projections and its dot plot will be scrutinized for any shift toward less restrictive policy. The dot plot is updated quarterly and shows, by way of individual dots, an assessment of each policymaker's midpoint level of the target range for the Federal Funds rate at the end of the year.

Fed Not Likely to Talk Up Rate Cuts Next Year

The Federal Reserve is looking for reassurance that inflation has been tamed and is on an inexorable path down to the desired range. Presently, the data-dependent Fed is not there because the data itself is not there.

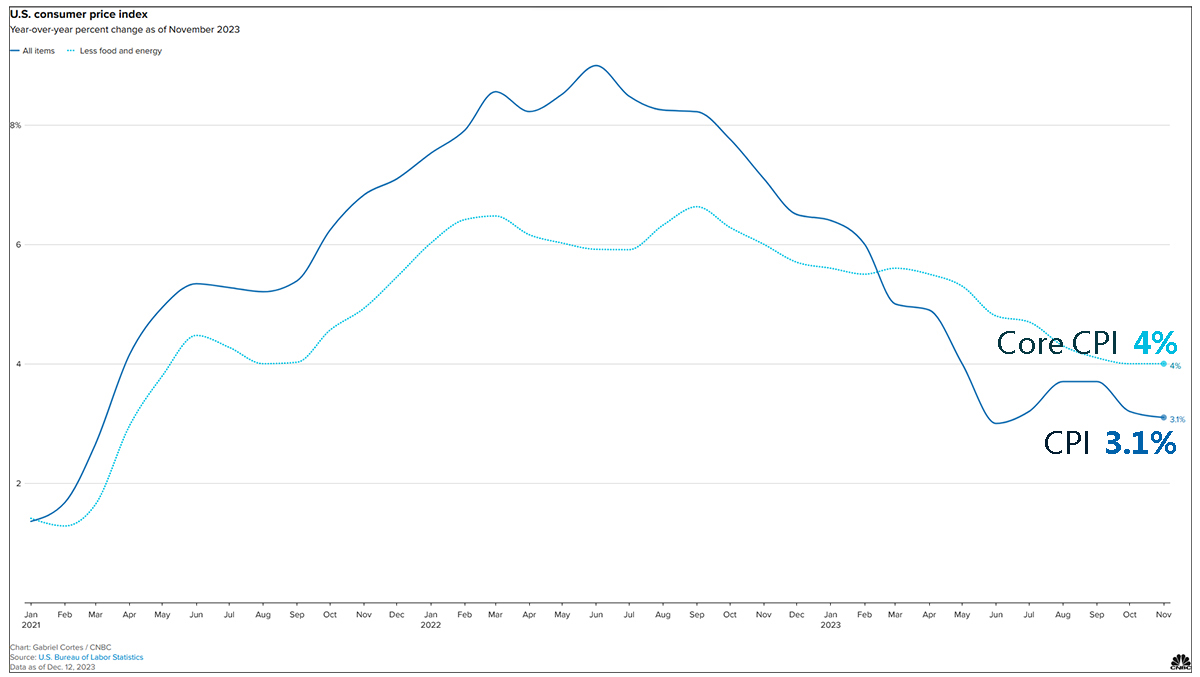

The core inflation rate for November was 4%, still twice the ~2% level desired by the Fed.

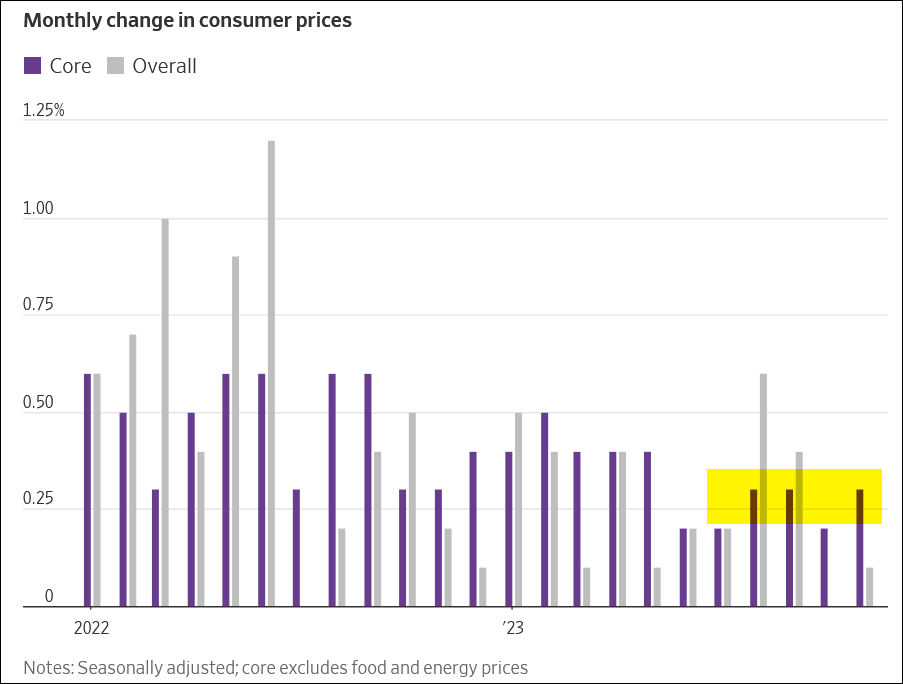

While the inflation data has been trending lower, the pace at which inflation has been declining has moderated. Over the past 3 months, core inflation change in monthly prices has been holding steady near a 3.6% rate.

The Fed is worried about declaring a premature victory and signaling a shift to a less restrictive monetary policy. The Fed will be more reassured if core CPI, or PCE, shifts down to a new lower level and maintains that for a few months. At the present pace of inflation improvement, that may not happen for a few months.

Conclusion

The market has rebounded sharply, with speculative buying returning as rate cut expectations in May 2024 have climbed. While a cut in the second quarter may occur if economic data softens on a steep trajectory, presently it is hard to see the Fed giving any rate cut signal after its meeting other than remaining watchful for inflation. The Fed does not have the data points yet to justify a shift in its market signaling.

If there is no softening in the Fed's posture following the meeting, the market can enter a consolidation phase. However, any softening on the Fed's part can prove to be a catalyst for the stock market to reach new highs.