Market Pulse

After 10 consecutive rate hikes, the Federal Reserve finally decided to put a pause to rate hikes at its highly anticipated meeting last week. However, the Federal Reserve projections noted that the rate-setting committee anticipated two additional rate hikes this year. The stock market did not miss a beat and kept trending higher, with the broader indexes of the S&P 500 and Nasdaq Composite closing at the best levels since mid-2022.

Lack of Fear of Rising Rates

The stock market's behavior last week stood out for its notable resilience in the face of what could only be characterized as adverse news from the Fed. Going into the meeting, the market had already baked in the expectation of a rate pause. Since this meeting also coincided with the quarterly release of the Summary of Economic Projections, it was much awaited to see how the Fed's projections may be shifting towards being less rigorous on rate increases and becoming more neutral and accommodating with a potential rate cut by year-end, a position that the market has been expecting for some time.

However, coming out of the meeting, the stock market did not get any such shift towards a less restrictive policy by the Fed, but on the contrary, the projections of the Fed governors showed two further rate hikes likely this year.

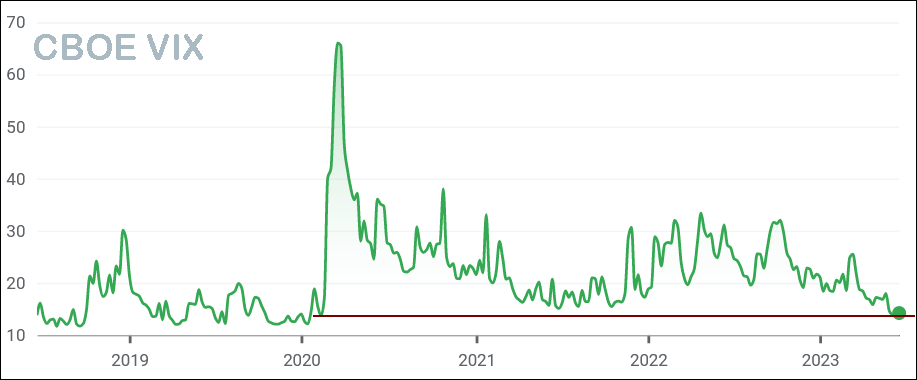

At any other moment in this rate hike cycle that began early 2022, the shifting of the summary projections to two additional rate hikes would have unnerved the stock market. But since the Fed announcement, the market trended higher last week. The CBOE's volatility index (VIX) closed at its lowest levels since mid-February 2020, days before the pandemic triggered a crash.

The muted volatility is typically when negative market surprises are rare. However, the Fed's higher interest rate expectation was material negative news. At this point the market is suggesting that the rate risk is overstated and the Fed is unlikely to follow through.

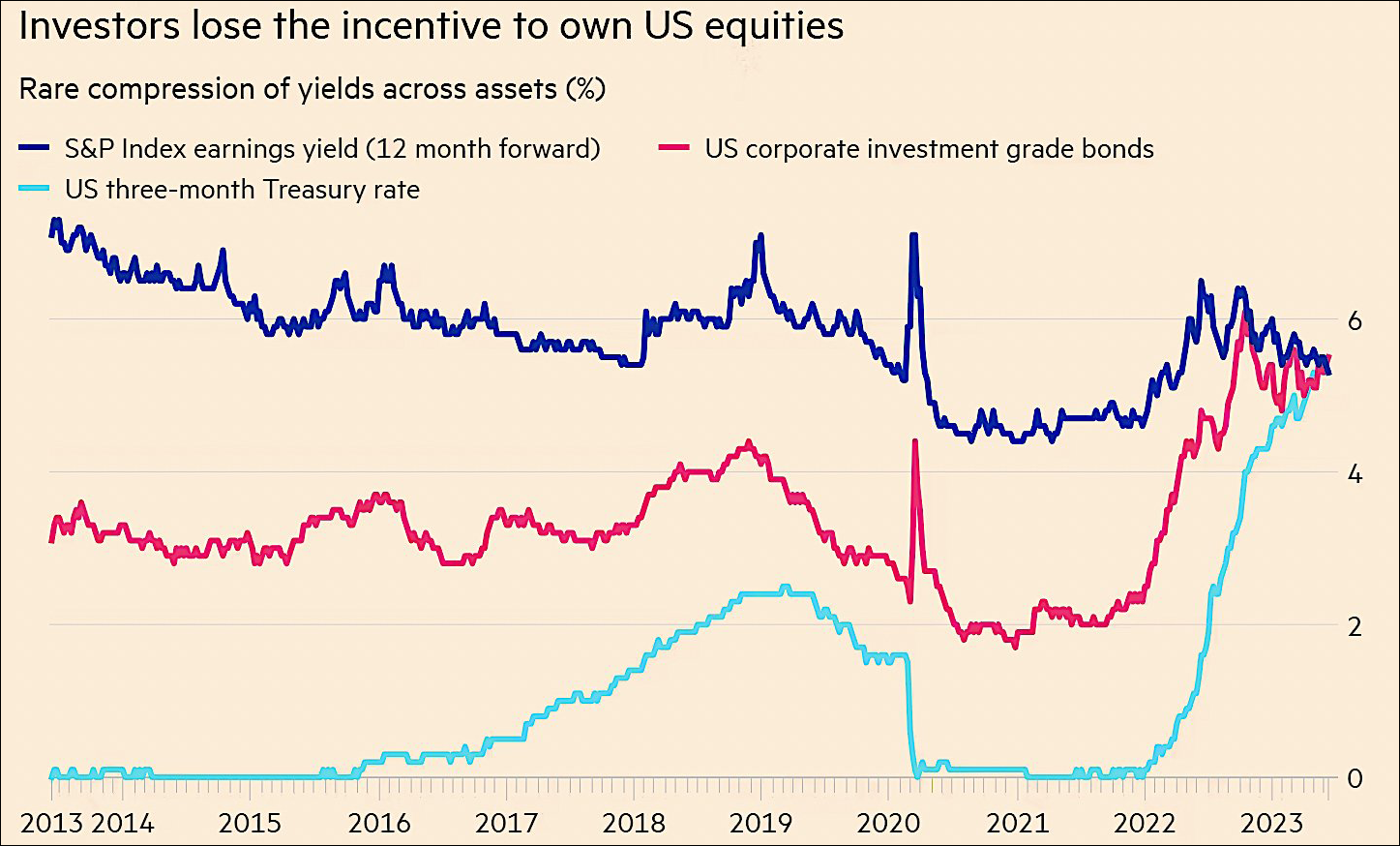

Recently, Financial Times presented an interesting observation of how for the first time since records have been kept, stock earnings yield, bond yields, and cash yields have converged.

The Glow from AI Spending

The spending boom resulting from AI initiatives has lit a fire under some of the biggest companies that are rapidly benefiting from the opportunity. These include companies like Microsoft (MSFT), Oracle (ORCL), Meta (META), Alphabet (GOOGL), Adobe (ADBE), and Amazon (AMZN), amongst others, which have led the Nasdaq Composite and the S&P 500 higher. The Nasdaq Composite index has been advancing for eight consecutive weeks.

However, where does the AI spending leaves the rest of the market, which may be still quite removed from receiving the immediate benefit in scale on the top and bottom lines? And that is a question the market will have to resolve as it seeks direction in the weeks ahead.

Conclusion

Are we entering a technology spending boom that will lift the valuation of the entire market even in the face of rising rates or does the market has to first work-off the risk of rising rates and its impact on the economy? The answer will determine if we can have an ongoing durable rally or a period of consolidation.

It is now widely anticipated that the Fed will announce a rate hike on July 26 at its next meeting. In our opinion, the market faces a challenge from the lingering hurdle of rising rates. Stocks have shown a tendency to surmount challenges since mid-March and may well do so again. We do believe that the potential for two additional rate hikes can hold back the advance until more inflation data is available in a few weeks. Favorable inflation data will mitigate interest rate risk, and vice versa. Investors should be more careful in acquiring new positions for the next few weeks. We remain 90% invested in our Prudent Healthcare and Prudent Biotech portfolios, and 60% invested in the Prudent Small Cap portfolio.

The article was first published on Seeking Alpha.