Small Cap Pulse

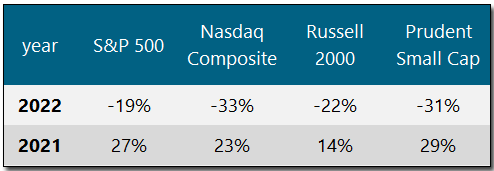

Small cap stocks fell with the broader market last year as the Federal Reserve's (Fed) campaign to bring inflation under control roiled financial markets. The small cap segment, which is a riskier segment, still did relatively better than the broader market and outperformed the Nasdaq Composite. The Prudent Small Cap portfolio also declined last year after strong performances in prior years.

Economic Uncertainty

Small caps run hot when the economy is growing. Uncertain economic growth and a looming recession are a big drag on small caps.

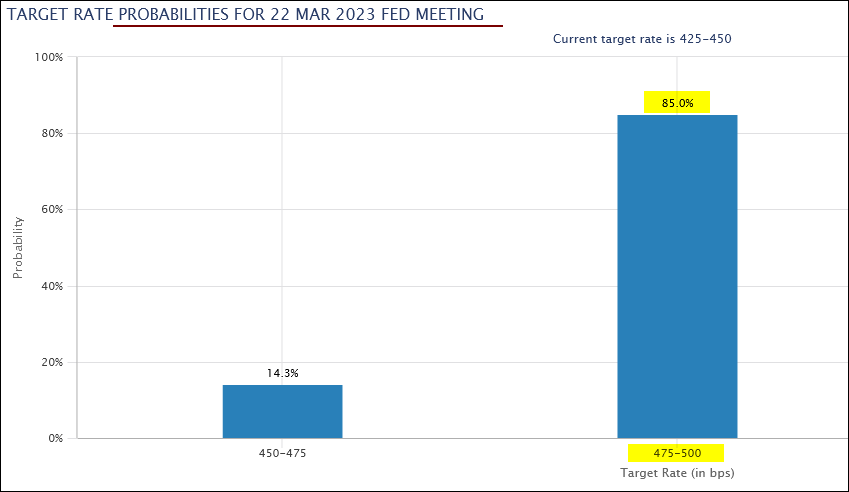

It is quite likely that the Fed will reach the peak interest rate in this cycle by the end of Summer if not earlier. Perhaps that peak rate is 5% to 5.5%, up from the present 4.5% level. However, what is difficult to predict is how long will the Fed remain at the peak rate. Put in other words, when will the first rate cut occur?

It is an answer completely dependent on the path the inflation data takes over the first half and how much it reassures the Fed of eventually reaching its target rate of around 2%. Rapid progress on inflation can set up a rate cut later in the second half. The Fed has not clarified to what level inflation must drop before it is reassured and considers shifting away from its restrictive policy. To avoid market instability and financial dislocations, the Fed must share its thought process in more quantitative terms in upcoming meetings.

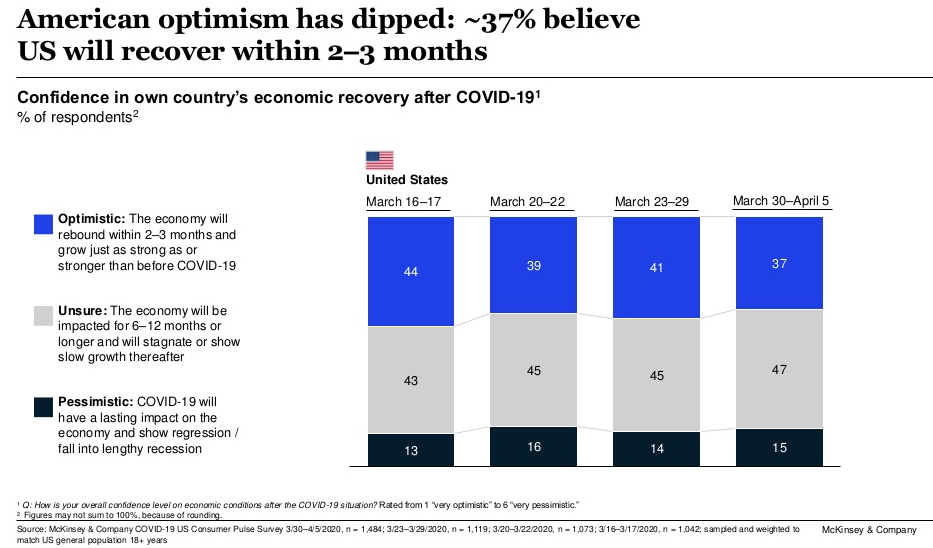

In the meantime, market fears are mounting that the economy is slipping into a recession. Earlier this month on earnings calls, leading US banks JPMorgan (JPM) and the Bank of America (BAC) characterized the upcoming slowdown as a shallow recession.

Typically, there are a few things that occur before an economic bottom, which heralds a new bull market. One such indicator is rising unemployment and another is a Fed rate cut. While this slowdown may not be the typical cyclically-induced recession, the raison d'être of the Fed's restrictive policy is inflation. The unemployment rate plays a vital role in contributing to managing inflation. Unless there is clear evidence of a downward trend in wage inflation, it is unlikely for the Fed to step back from its restrictive policy and contemplate a rate cut.

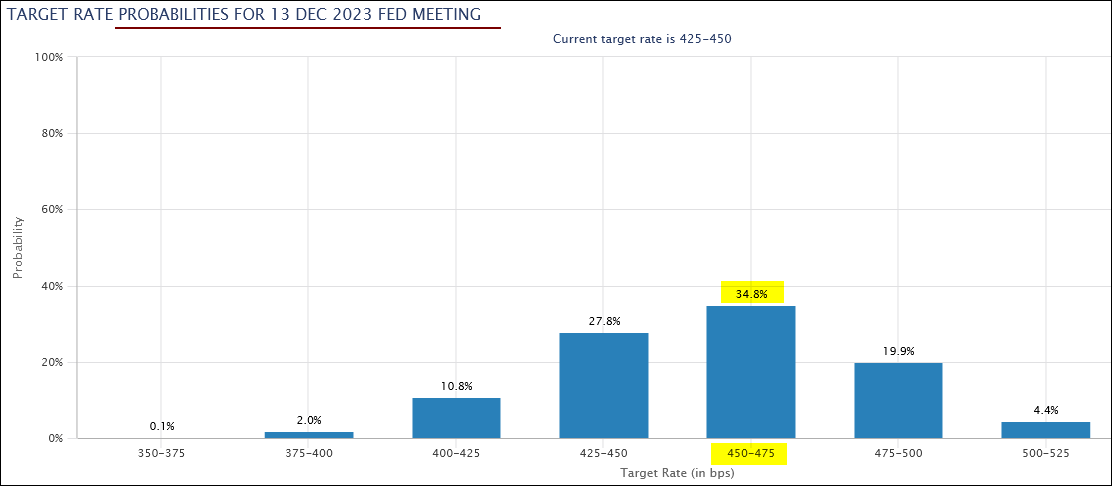

The market has started on a strong note in January. This indicates a growing belief that the Fed will arrive at the peak rate of 5% at the March meeting, and thereafter a rate cut in December, an expectation that has already recently shifted from November. In our opinion, there is a much greater than a 50% chance that the peak rate goes over 5%. If unemployment does not begin to contribute towards reducing inflation in the next few months, then the market will have to reset these expectations towards a higher peak rate and a rate cut that slips into next year.

Opportunities Abound In Small Caps Stocks

Assuming that economic pain is still ahead of us, the small cap segment can have an uphill battle in sustaining a rally. The stock market is discounting an economic slowdown and perhaps a shallow recession. However, to sustain a rally based on future economic growth, more clarity on the Fed's restrictive policy will be needed. There have been tangible improvements in inflation, but still a long way to go. The Fed's economic and policy commentary on February 1 will provide further insights into the central bank's viewpoint.

After a sharp rally, there is a high likelihood for the market to pull back and consolidate. This will be a very active earnings week combined with the Fed's update mid-week. The Fed may take the opportunity to rein in the rally in the financial markets as sharply rising asset prices can become counter-productive to its inflation targeting.

It makes sense to gradually build exposure to small cap stocks and increase it with cyclical stocks as the year progresses. In the present environment, growth stocks in more defensive sectors like healthcare can be preferred. Such stocks can do well if the Fed maintains a restrictive policy for longer. More can be read in the recently published healthcare outlook and the biotech outlook.

Opportunities also exist this early in the year in energy, clean energy, automotive, semiconductors, etc.

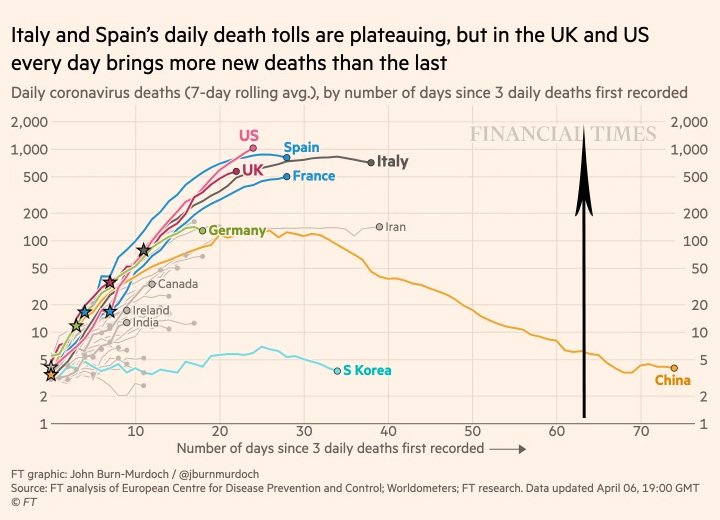

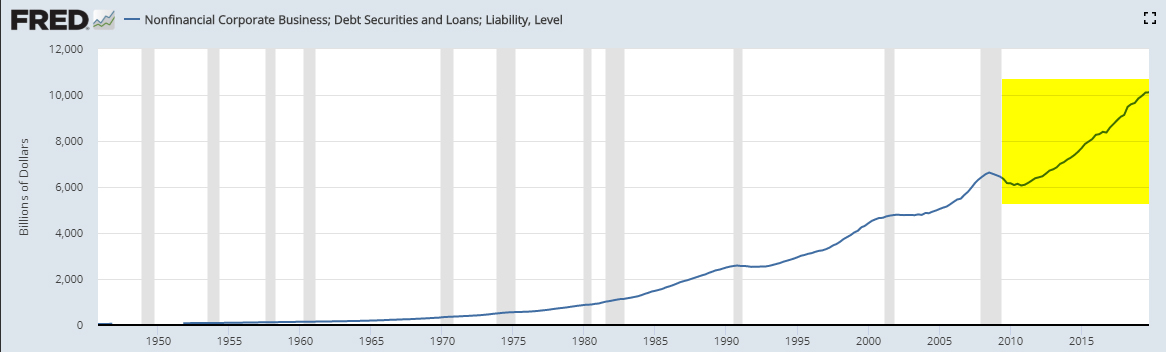

The market decline that started in 2022 is the first sustained pullback since the time of the Great Recession in 2008.

The best time to invest in stocks is when an economic bottom is close at hand. Investors this year will be presented with typically a once-a-decade golden opportunity as the bear market approaches its final stages. No bell tolls at the end of the bear market. Thus, a phased approach mentioned above is prudent than staying on the sidelines or being fully invested in cyclically-influenced growth stocks.

We believe the small caps can deliver returns of 15% to 20% and perhaps higher during 2023. This assumes the current market expectation of a 25 basis point increase in February, a March peak in interest rates, and a rate cut in December this year.

There are many strong small cap companies and the opportunities are going to become numerous as the year matures. A few promising small cap companies, that may already be part of the Prudent Small Cap or other model portfolios, include TransMedics (TMDX), Aehr Test Systems (AEHR), Modine Manufacturing (MOD), CECO Environmental (CECO), ATI (ATI), Rhythm Pharmaceuticals (RYTM), Akero Therapeutics (AKRO), Viking Therapeutics (VKTX), Harmonic (HLIT), IVERIC bio (ISEE), TG Therapeutics (TGTX), Verona Pharma (VRNA), Alphatec Holdings (ATEC), and Collegium Pharmaceutical (COLL).

The article was first published on Seeking Alpha.