Our Newsletter Services

A System-driven Approach to Investing and Building Wealth |

The Path Forward...

"In 1988 I decided it’s going to be 100% models, and it has been ever since"

Jim Simons, Mathematician and $65 billion Quantitative Hedge Fund Manager

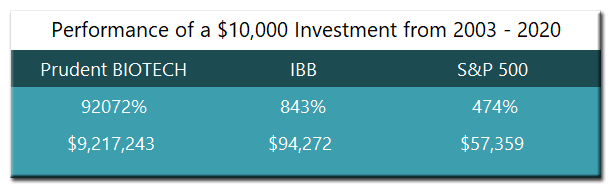

Biotechnology

Biotechnology is a return-rich as well as a volatility-rich sector, driven by the promise of new drug discoveries. Even though biotechnology is a smaller industry group in size, it remains one of the most powerful, fueling the performance of the healthcare sector. The model portfolio comprises up to 8-stocks and focuses on meaningfully outperforming the benchmark Nasdaq Biotechnology Index denoted by the ETF symbol IBB. It is a monthly publication with occasional intramonth updates. The Prudent Biotech Newsletter was first available to subscribers in January 2016. Performance prior to 2016 is back-tested.

High Risk and High Reward. The model portfolio is suited for investors who have determined that an aggressive posture for a portion of their portfolio is appropriate. For more information on the newsletter, performance, pricing, and signup, please visit PrudentBiotech.com or click below.

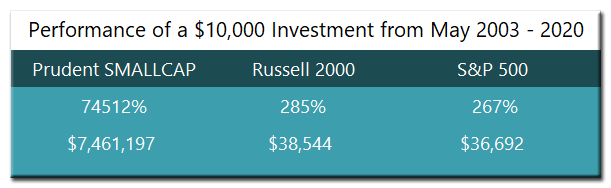

Smallcap Investing

The Prudent Small Cap model portfolio, with a publishing history of over 10 years, targets a universe of stocks from $200 million to $3 billion in market capitalization. Using a quantitatively-driven systematic investing approach, the product focuses on the promising names in the Small Caps and early Midcap (SMID) segment, which offers some of the greatest opportunities for capital appreciation in the broader market, but also possess a much higher level of volatility. The model portfolio comprises up to 10-stocks and focuses on meaningfully outperforming the benchmark Russell 2000 Small Cap Index. It is a monthly publication with occasional intramonth updates. The newsletter was first available to subscribers in May 2003.

High Risk and High Reward. The model portfolio is suited for investors who have determined that an aggressive posture for a portion of their portfolio is appropriate. Click below for more information about the newsletter, performance, pricing, and signup.

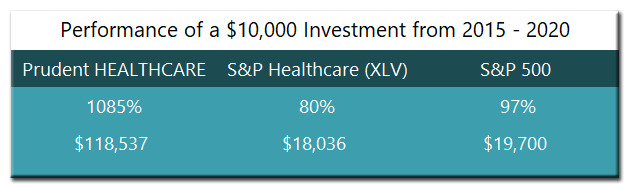

Healthcare

Healthcare possesses tremendous potential. It has unique characteristics of being relatively defensive, as it resists the tug of economic downturns, while possessing the unbridled dynamism of medical products, biotechs, and medical services that can fuel the sector returns. It is important to invest in the sector with a clear investing methodology, recognizing the significant investing potential and managing the higher risk. The Prudent Healthcare model portfolio service focuses on achieving risk-adjusted returns that meaningfully outperform the benchmark S&P Select Healthcare Index denoted by the ETF symbol XLV. The model portfolio comprises up to 10-stocks and is a monthly publication with occasional intramonth updates. The service was launched in 2019, and became available for subscription on the Seeking Alpha website in Jan 2020. Performance prior to 2019 is back-tested.

High Risk and High Reward. The model portfolio is suited for investors who have determined that an aggressive posture for a portion of their portfolio is appropriate. For more information on the newsletter, performance, pricing, and signup, please click below. This model portfolio newsletter service is available on Seeking Alpha website.

Risk Free, 60 Days Money Back Guarantee

We will do our best to provide you with an excellent product to contribute towards your wealth-building goals through disciplined investing. We back this with our guarantee that if you are unsatisfied for any reason with the subscription, you can cancel at any time within 60-days of your Payment for a full refund. No questions asked. So you have 60-days to make up your mind without refund worries and see if the product can contribute to your financial goals. After 60-days, no full, partial or pro-rated refunds are done.

Since I'm quite active in the markets, I was sceptic about a hands-off approach. But I see the results from this discipline. Thanks for helping!

Marty H., Texas

This is awesome. It required patience at first but then it comes together. Up and away. I should become an affiliate for you 🙂

Richard E., Florida

Just a Few Highlights of What Each

Newsletter Offers ...

- A Systematic Investing Approach

- A Quantitative Model Portfolio

- Know When to Buy, Sell or Just Wait

- Freedom from Constant Research and Tracking

- Leverage Quant Techniques Like Hedge Funds are Doing

- Performance and Risk Management

- Track Record of Market-Beating Performance

- 60-day Money Back Guarantee

Graycell Advisors, and its affiliates, officers, employees, families, and all other related parties, collectively referred to as ‘Graycell’ and/or ‘we,’ is a publisher of financial information, such as the Smallcap, and Prudent Biotech newsletters. We are not a Registered Investment Advisor (RIA). Historical performance figures provided are hypothetical and unaudited, and based on our proprietary analysis and system performance, back-tested over an extended period of time. Hypothetical or simulated performance results have limitations, and unlike an actual performance record, simulated results do not represent actual trading and consequently do not involve financial risk of actual trading. The performance results obtained are intended for illustrative purposes only. No representation is being made that an account will or is likely to achieve profit or losses similar to those shown. Past performance is not indicative of future results, which may vary. All stock and related investments have a degree of risk, which can result in a significant or total loss. In addition, biotech sector and smallcaps are characterized by much higher risk and volatility than the general stock market. Information contained herein is general and does not constitute a personal recommendation or takes into account the particular investment objectives, financial situations, or needs of individual investors. If you decide to invest in any of the stocks of the companies mentioned in the newsletters, samples, alerts, etc., sent to you or available on our websites, you can and may lose some or all of your investment. You alone are responsible for your investment decisions. Use of the information herein is at one's own risk. We are simply sharing the results of our model. Nothing should be construed as a recommendation or an offer to buy or sell any securities, and we are not liable nor do we assume any liability or responsibility for losses incurred as a result of any information provided or not provided or not made available in a timely manner, herein or on our website or using any other medium. We cannot guarantee the accuracy and completeness of any information furnished by us. We may or may not have existing positions in the stocks mentioned in our reports. Our models are proprietary and/or licensed, and can be changed or revised based on our discretion at any time without any notification. Subscribers and investors should always conduct their own due diligence with any potential investment, and consider obtaining professional advice before making an investment decision.

© Graycell Advisors. All rights reserved. Any act of copying, reproducing or distributing this newsletter whether wholly or in part, for any purpose without the written permission of Graycell Advisors is strictly prohibited and shall be deemed to be copyright infringement.