- May 16, 2017

- Controversies are now typical of the new Trump administration.

- In spite of jolting political news, the market remains in a steady uptrend.

- Earnings and growth trump political turmoil as long as economic implications are limited.

- The market is patient, but the patience is not finite.

- Staying the course instead of predicting corrections has been the best course since late last year.

The Bottom Line

Even in a flood of alarming political news and unconventional practices, the market focuses on earnings and economic growth prospects.

It Hasn't Helped Chasing Tales

The market has been overvalued for, well, a long time, based on quite a few metrics often cited, and ongoing commentary from many experts and non-experts. In the past couple of articles, including Is The Market’s Hour Up, we had highlighted some missed calls from leading and well-respected market oracles. But perhaps, it is not the fault of the prognosticators. After all, the market has resisted all efforts in applying traditional valuation templates.

The truth has been that over the past six months a better strategy has been to stop predicting a Correction and staying the course in a rejuvenated Bull market.

The onslaught of unsettling political news has investors on the edge and fearing a sharp correction. But such news has not had a negative impact on the stock market performance.

Instead, the market almost appears insulated from such concerns and remains focused for now on key growth metrics, particularly earnings that are generally coming in better than expected. This continues to support valuations.

At the beginning of April 2017, earnings of S&P 500 (SPY) companies for the first quarter of 2017 were expected to grow at a 9% rate. With 415 of the 500 companies reporting earnings as of last week, nearly 75% of them have exceeded the earnings estimate, and 66% outperformed on the top-line revenue estimates, as per Factset. This strong performance is putting the S&P 500 earnings growth rate for the quarter at 13.5%, well ahead of the 9% expectation.

That is a good enough reason for stocks to move higher, as they have, led by the relentless Nasdaq (QQQ). The S&P 500 has also made a new high after a two-month consolidation, while the Dow Jones Industrial Average (DIA) hovers just 1% below its all-time high.

The small-cap stocks have been marching to their own tune. After a rambunctious 2016, when the Russell 2000 Index (IWM), a small cap benchmark, surged +19% and our Graycell Small Cap Portfolio +71%, the index has been trading in a tight range since mid-December 2016. The near 4-month consolidation ended with the index marking a new high in late April, on a general improvement in risk appetite driven by stronger earnings.

The 12-month forward P/E ratio for the S&P 500 stocks remains at 17.5, around where it was at the end of the March quarter, and above the 5-year average of 15.2, as per Factset.

The Good is Being Overshadowed

As Warren Buffett has noted, the hardest thing for an investor is to take a position and then sit on their hands.

And it has been hard!

If the stock market was looking for an excuse to correct, there has been no scarcity of reasons this year for the market to capitulate. The Trump presidency can be mildly characterized as unconventional. The daily news turmoil tempts a reaction. Investors can be provoked to act, even if it means abandoning positions and staying out of the stock market.

The question remains:

How in the world can we lurch from one crisis to the next, and the stock market remains bullet-proof?

The answer probably is:

The market continues to see a more promising earnings and economic growth picture, and in the end, that's what counts the most.

The stock market has disregarded the political concerns, chiefly, because of three reasons - Earnings, Economy and Monetary Policy - which have remained supportive of valuations. In addition, the anticipation of a new pro-business policy regime with lower taxes and fewer regulations has kept the market optimistic about the future.

Furthermore, the global economic picture has an upward bias. Trump has nothing to do with global growth.

The International Monetary Fund ((IMF)) last month forecasted global growth at 3.5% in 2017, which will be higher than 3.1% achieved in 2016. The Eurozone fears of an economic disaster have dissipated and political concerns continue to ease, allowing the region to be positioned in 2017 for its strongest growth in recent years. China appears to have emerged from what was anticipated last year to be a prolonged slowdown. Stronger growth abroad benefits US exports.

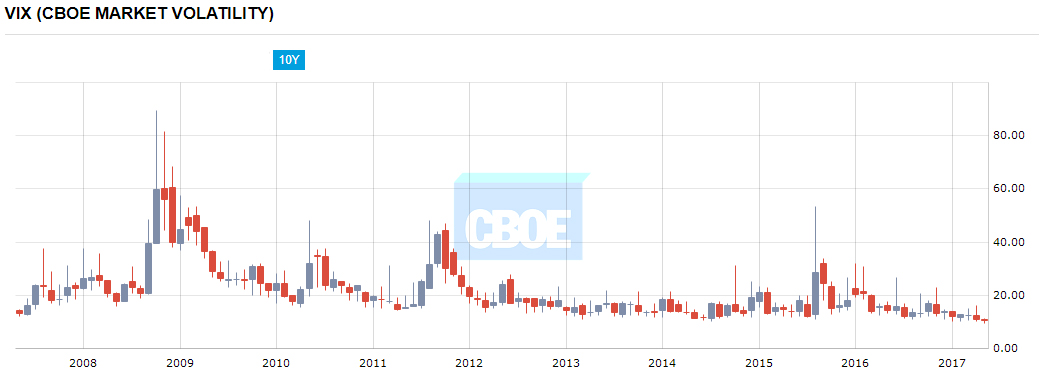

It appears that globally, Risk is being averaged down, offset by a better economic climate. The VIX Index, also termed the fear gauge, reflects this observation as a few days ago it recorded its lowest reading in 25 years, since 1993.

In the US, we have been in a somewhat Goldilocks scenario, where economically the key supports have been optimally positioned for the market - earning growth, a mild interest rate environment, and the promise of more pro-growth policies. This is a heady combination for generating investment returns.

It doesn't mean that things will not change. In fact, if one observes the situation from a probability distribution standpoint, an argument can be made that there exists a higher probability of some of the key drivers to eventually slip out of their optimal ranges.

Any cracks or unexpected changes in the Earnings, Economic Growth, and Monetary Policy can presage a deep correction. In addition, a sweeping and persistent decline in sentiment, if it jeopardizes economic growth, can also create an environment for a correction.

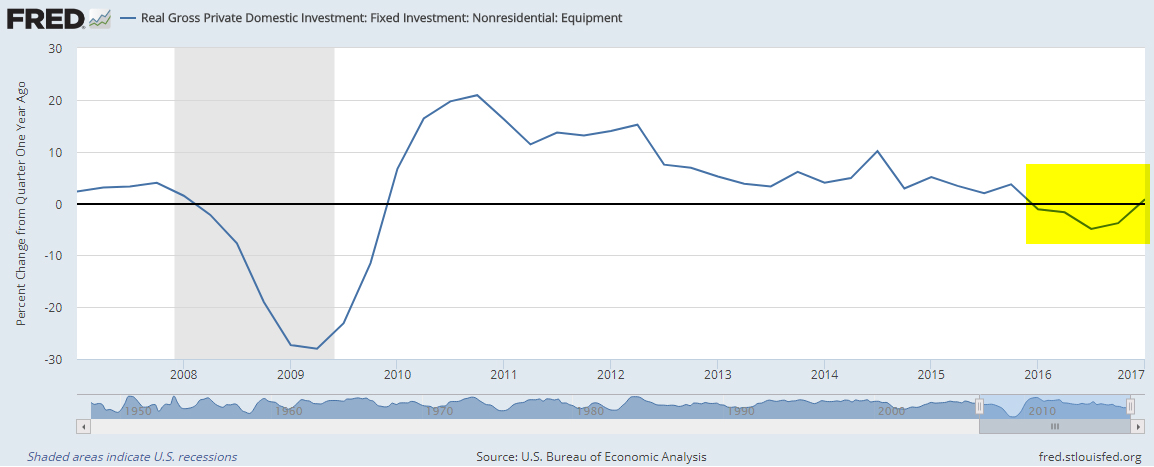

There has been a little pullback in consumer confidence, as represented by the Bloomberg Consumer Comfort Index. But that is to be expected as readings reached 15-year highs. At the same time, business investment spending, which did not throw its weight behind economic growth since late 2015, has finally begun to ascend, as shown in the chart below.

Rising business spending and a tighter job market, holding at a near full employment rate, affects monetary policy by creating a faster ramp-up of the Federal Reserve's ((FED)) inflation indicators, notably the PCE, to optimal targets. This can create a rationale at the FED for a steeper interest rate path from the current two additional interest rate increases forecasted for 2017. Offsetting the inflationary argument to some extent are the drop in oil and gas prices and the continuation of a tremendous efficiency boost in the economy.

The Cup Filleth But Not Runneth Over, Yet!

There is a real risk of a tremendous slowdown in the administration's governing agenda if incessant distractions continue to tie-down the White House. The jolting firing of the F.B.I. Director can have broader ramifications for market sentiment if it erodes confidence in Trump to the point where his policy agenda becomes significantly delayed or impossible to achieve.

The constant stream of political issues is filling the proverbial cup of misery for many investors, even though it is not yet impacting the broader economic picture.

Well, this is how a mercurial Trump presidency will be, and the controversial and friction-seeking working style and a bag of controversies are not going to change. Investors have to adapt and by now expect the abnormal from the White House while keeping a keen eye on the economic backdrop and its key plinths.

We believe the market will continue to be patient till such time that the economic agenda appears to remain somewhat on-track. But patience is finite.

There is a real risk that the combustible controversies can fill and overflow the cup. The market may then run out of patience.

But we are not there yet!

Conclusion

At the beginning of the year, in our January 2017 article titled "Market Outlook For 2017," we noted:

At this time, we believe the first-half will be better for stocks, than the second half, primarily because of fear of unrealized expectations. For the year, we believe the major indexes of S&P 500, Nasdaq, and small cap Russell 2000 to post double-digit gains... Till such time there is further evidence of this [unrealized expectations] risk rising in probability, the prudent course is to stay invested.

We believe this roadmap providing an investing framework at the beginning of the year still remains valid.

At this point, we remain fully invested both in our Prudent Biotech and Small Cap portfolios. There are a good many ideas to look at for building a portfolio. In the small and mid cap space, some promising names include Irobot (IRBT), Universal Display (OLED), RH (RH), Mazor Robotics (MZOR), Brooks Automation (BRKS), Applied Optoelectronics (AAOI), MiMedx Group (MDXG), Pegasystems (PEGA), Weight Watchers (WTW), Targeted Therapeutics (TGTX), Achaogen (AKAO), Kemet (KEM), Kronos Worldwide (KRO), and Arcos Dorados (ARCO), to name a few.

In a recent article, Biotech Bonanza - Approaching An Inflection Point, we had listed a portfolio of attractive companies including Axovant Sciences (AXON), Exact Sciences (EXAS), Vertex Pharmaceuticals (VRTX), Neurocrine Biosciences (NBIX), Foundation Medicine (FMI), and Supernus Pharmaceuticals (SUPN).

As always, do your own due diligence and invest in a portfolio of stocks reflecting your risk tolerance.